Skip the searching and find the top financial products of 2024, all in one spot. From insurance companies to investment accounts, we’ve got you covered.

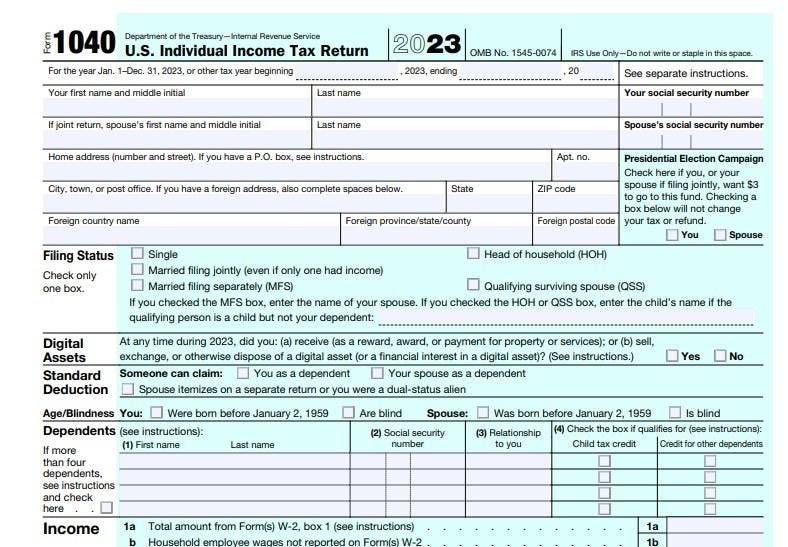

Taxes

Federal Court Grants Summary Judgment Motion On Willful FBAR Penalty

Litigation in federal court is analogous to a game of chess. Although each side has…

What Is Earned Income? Examples and How to Calculate

When it comes to taxes and financial planning, you need to know the IRS has…

Form 8283: How to File for Noncash Charitable Contributions

When you donate noncash items—such as artwork, vehicles, clothing or other property to a qualified…

Form 8396: How to Claim Mortgage Interest Credit

Form 8396 is used to claim the mortgage interest credit. This is a nonrefundable federal…

Section 83(b) Election for Stock Options: Deadline, Examples

An 83(b) election lets individuals who receive restricted stock or stock options pay taxes on…

Standard Mileage Deduction: Requirements, Rate and Examples

If you use your personal vehicle for business or other specific needs, you may be…

California vs. Florida: Which Is Better for Taxes?

When comparing California vs. Florida for taxes, the absence of a state income tax in…

New Jersey vs. New York: Which Is Better for Taxes?

Comparing New Jersey vs. New York taxes highlights differences in how income, property and sales…

LLC vs. Corporation: How to Decide for Your Business

Choosing between an LLC and a corporation can affect how you pay taxes, raise money,…

Tax-Exempt Interest Income Examples

Certain investments, such as municipal bonds, can generate interest that is exempt from federal, and…

What Are Pre-Tax Benefits and Deductions?

When evaluating a job offer, salary isn’t the only factor to consider. Pre-tax benefits can…

6 Tax Benefits of Having a Child: Credits and More

The IRS offers a number of tax benefits that support families. These opportunities can help…